Today’s consumers demand an improved customer experience. Regardless of what they are purchasing, they expect the ease of shopping online and having their package show up two days later. Life insurance is no different, but you can’t improve the customer experience without change.

Underwriting consumes a large amount of time in the application process, and consequently, it has become one of the primary focuses for insurance carriers over the last three to five years – leading you to pursue innovative tools to speed up your processes.

Life insurers using automated underwriting tools say they save up to 90% in cycle time, resulting in a speedier underwriting process, according to Celent.

But implementing the necessary tools and technologies for automation can be an overwhelming process, because after all, change can be hard.

One thing is for sure: technology is constantly changing. While these technological innovations are designed to improve the way things are done, it can be incredibly intimidating and overwhelming to take that first step.

So how do you prepare for change? By implementing technology that accelerates your business in a sustainable and scalable way.

Adopting new technology can help propel your business into the future and give you an edge over your competition. But you also need to select the right technology to make that adoption sustainable and enable you to tap into ongoing growth.

We can share some tips on how to do just that.

Here are 5 Key Takeaways from our recent underwriting webinar series. Check out these bits of wisdom for staying on top of industry trends and preparing for the future:

- Digital acceleration is top of mind for insurers, and efficiency and ease of doing business are top priorities when it comes to adopting new tools. Insurers are looking to realize value by providing customers with the experience they desire. This informs how you should assess new technologies. Is the solution going to make things easier and faster for the customer? If it doesn’t, or if it can’t in its current stage, then it isn’t worth investing in at the current time.

- Customer experiences have changed. Most customers desire an omnichannel experience. They want an easy way to purchase life insurance in a digital environment, but they still want to have a personal relationship with the agent – someone who can answer their questions and provide personalized guidance. How this relationship takes place, however, has also shifted. The use of features like chat and virtual meetings continues to remain prevalent as the industry moves past the pandemic because convenience is key to meeting customer expectations.

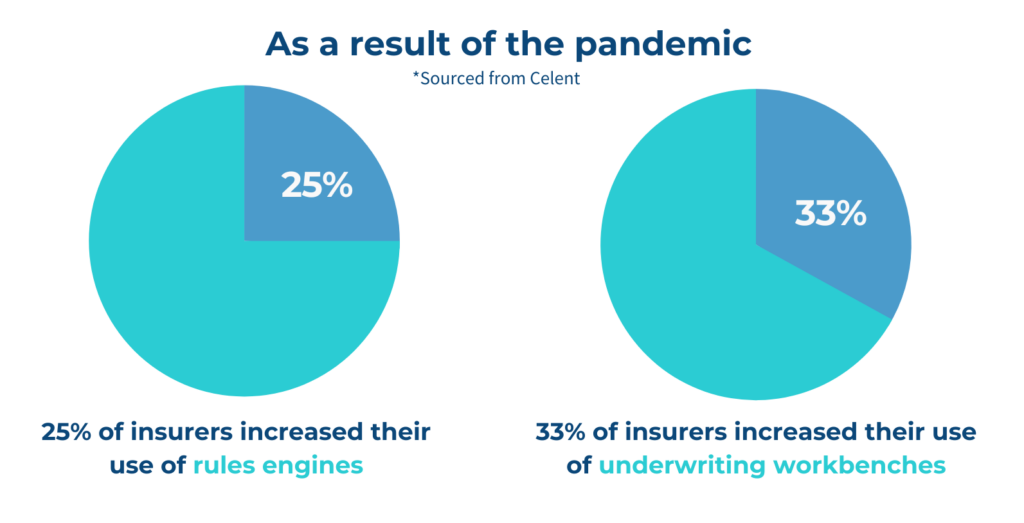

- More insurers are using rules engines and underwriting workbenches. Celent data shows an increase in using these, by 25% and 33% respectively. Tools such as these help to facilitate accelerated underwriting, and as the industry continues to evolve, speed and efficiency will remain differentiating factors.

- Data required for making underwriting decisions is growing and changing. Data sources like RX and the Medical Information Bureau are commonly used in the industry, but some insurers are venturing out and exploring other types of data, like APS Summaries and Electronic Health records. The practice of utilizing behavioral data – like credit scores and application behavior – is growing and nearly 40% of insurers have started implementing AI or Machine Learning models into their underwriting, according to Celent. Data sources continue to expand, to now include data from wearable devices, but as this expanded consumer data is gathered, it will continue to be important that all data that you examine, analyze, and use is done so in an unbiased manner.

- Partner security with convenience. As you look to incorporate new data sources, it is critical to remain vigilant, recognizing the regulatory requirements and limitations. Data is valuable, but it brings privacy concerns that must be taken into consideration – especially with the use of consumer data sources like credit scores or wearable data. Don’t be afraid to seek new data sources – just be sure to do your homework, analyze the evaluation, and check all the boxes first.

Well, there you have it. We hope that these insights have helped prepare you to tackle the ever-changing landscape of the life insurance industry. If you are interested in learning more about any of these topics, be sure to check out our Underwriting Webinar Series.

If you are ready to explore an automated underwriting solution that offers speed and efficiency using an underwriting workbench and a fast rules engine, let’s chat about Resonant®.