An Agency Management System (AMS) isn’t just crucial for running your agency smoothly; it also impacts how efficient and productive you are, directly affecting your success. But with so many choices out there, finding the right one can be challenging. To simplify things, here are six key factors to keep in mind.

1. Efficient Automation of Routine Activities

AMS software can automate time-consuming and routine activities, enabling your staff to concentrate on tasks that add greater value to your agency. An AMS solution for an insurance agency must optimize organizational processes while seamlessly accelerating tasks – such as requirement gathering and commission tracking – while reducing the need for manual intervention. Look for automation that efficiently delegates repetitive and time-intensive tasks, which will then free up time you can spend on customer service.

2. Centralized Customer Data and Records

As your agency expands, the complexity of storing customer information grows, which presents a challenge in data management. AMS software can help by combatting this directly through centralizing customer records and data, ensuring both accessibility and organization. This consolidated view includes application statuses, policy details, renewal dates, and coverage information, and will empower your agency staff to more efficiently serve customers.

3. Effective Multiple Touch Points for Communication with BGAs and Agents

Choose an AMS that includes integrated CRM capabilities that has multiple touch points. By providing access to both pending and historic business records, you’ll enable your sales team to stay informed about ongoing cases, record essential notes, and even schedule follow-ups across multiple touch points with agents.

4. Powerful Dashboards and Analytics

Help your agencies visualize key customer and industry metrics by selecting an AMS that offers analytics and benchmarking capabilities. This enables you to leverage data and forecast sales, which is critical in improving the growth of your business. Data-driven insights – such as case trends as well as performance metrics for agents, case managers, and carriers – can help ensure you never miss vital information.

5. Out-of-the-Box Integrations

Look for an AMS solution that easily integrates with other solutions. By adding an e-Application solution, you can streamline the process, significantly decreasing the data entry time by automatically generating and approving cases. Adding an e-Delivery solution will add additional efficiency by enabling your team to electronically access the status history of a policy.

6. A Streamlined Onboarding Process

A smooth customer journey starts with a streamlined onboarding process. Consider an AMS solution that is backed by a robust customer support team to help you build trust and loyalty.

With each AMS solution, it’s important to look at the overall comprehensiveness as that is a solid indicator of future effectiveness. Automation and digitization can help you reduce the time dedicated to handling back-office tasks and allocate more time to revenue-generating endeavors, which enhances your business’s performance while also improving the overall customer experience, which benefits both your company and your clients.

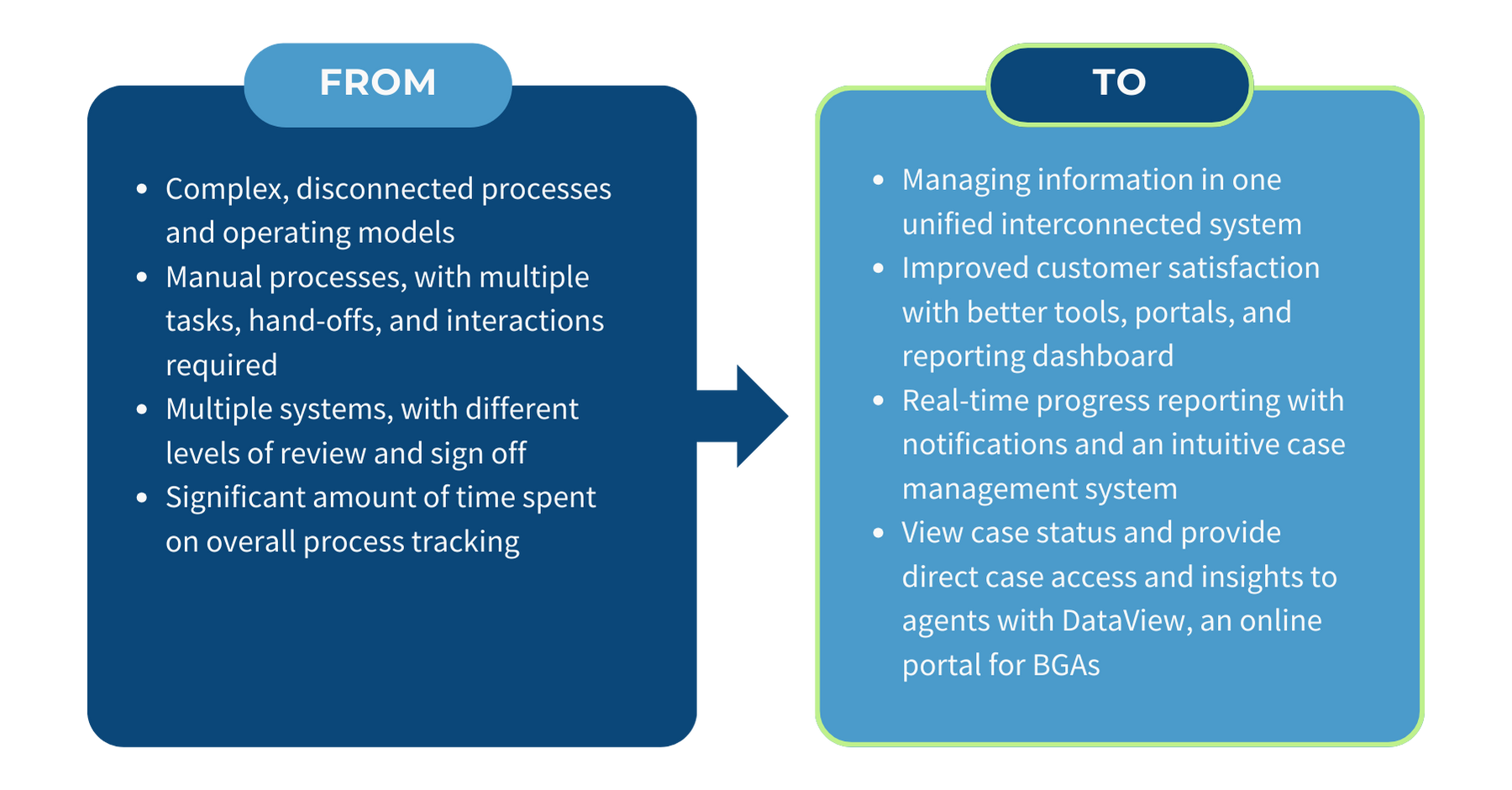

Moving from Challenges to Benefits

As agencies are confronted by complex customer requirements, many face a range of obstacles that can slow down their progress.

If you’re looking to overcome friction points and barriers and are looking for an AMS solution that will help you be more efficient, check out Agency Integrator, the AMS solution, from iPipeline: We’ve watched first-hand how Agency Integrator has streamlined agency operations by taking you:

I’d love to talk to you more how Agency Integrator, iPipeline’s Agency Management Solution, can help! Click here for more information or contact us directly.

About the Author

Robert “Bobby” Powell spent 15 years at Laser App as the Vice President of Sales and Marketing. He joined iPipeline in 2017 when the company acquired Laser App.

Bobby currently serves as Vice President of Wealth Management Sales, leading Wealth Management and Insurance distribution sales teams at iPipeline.

In his free time, Bobby enjoys camping, hiking, and fishing with his family, as well as attending Dodger games and any other outdoor activity involving sunshine.