Simplify Your Annuity Order Entry System

Estimated Read Time: 4 minutes

Blog Summary: This blog explores the inefficiencies in outdated annuity order entry systems and how modern platforms like AFFIRM® can reduce NIGO, improve compliance, and simplify advisor workflows. Learn why smarter annuity technology is essential for reducing friction and driving sustainable business growth.

Annuities are complex. Your order entry system shouldn’t be.

From shifting regulations and suitability rules to carrier quirks and advisor burnout, the barriers to ‘in good order’ submissions keep stacking up. Yet the very platforms designed to simplify annuity sales often do the opposite, piling on extra clicks, redundant tasks, and unnecessary friction.

Too many order entry systems still operate like they were built from a different era, one where manual updates, inconsistent workflows, and recurring fees were simply “how it’s done.”

Your annuity order entry system should do what it was always meant to; lighten the load, not add to it.

What Advisors and Firms Are Saying

We’ve spent years talking to firms of all sizes from national enterprises to independent broker-dealers, and the message is clear.

You don’t need more tech. You need better tech.

You need systems that:

- Adapt to your workflows, not the other way around

- Support industry standards like ACORD and PPfA

- Drive advisor adoption, not resistance

- Reduce NIGO rates, not create more rework

- And most importantly, don’t surprise you with hidden costs

The Real Cost of Friction in Annuity Sales

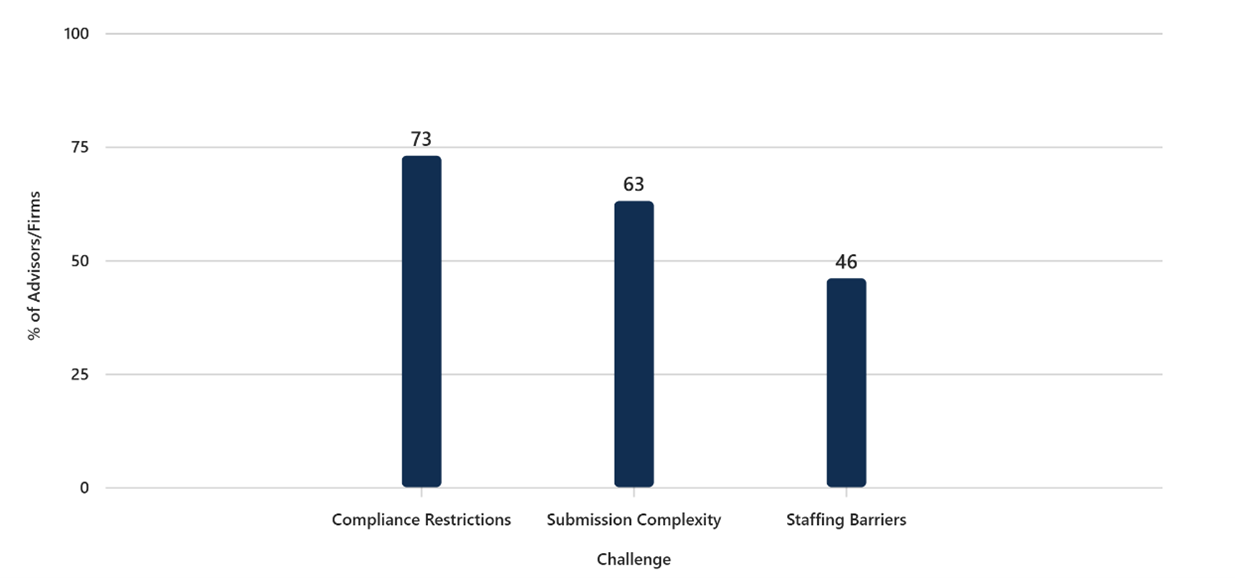

The numbers speak for themselves: friction isn’t just frustrating, it’s costing firms time, money, and growth. 73% of advisors say compliance restrictions make tech adoption harder1, slowing progress before it even starts. Add to that the complexity of annuity submissions,63% say annuity submission processes are too complex, and efficiency takes a hit. And when 46% cite insufficient staff as a barrier to offering planning services, the message is clear: the right technology isn’t just nice to have, it’s essential for growth.

A modern annuity platform should simplify workflows, automate compliance, and reduce the risk of NIGO submissions—giving advisors more time to focus on clients, not corrections

Figure: Advisor Challenges with Annuity Tech Adoption

Sources: LIMRA Secure Retirement Institute, “Advisors’ Views on Making the Annuity Sales Process Simpler”; Cerulli Associates via InvestmentNews, “Three-quarters of advisors flag compliance as a top tech challenge”; Cerulli Associates, “State of U.S. Wealth Management Technology 2025”

Why the Right Tech Partner Matters

Innovation should feel like clarity in motion—focused, energizing, and built to remove barriers. It’s not about adding complexity; it’s about unlocking simplicity that drives real business outcomes. It should empower your people, accelerate your progress, and, above all, create momentum that moves your business confidently forward.

And perhaps most importantly, firms need partners not just vendors. Partners who show up, listen, and evolve with your business.

Annuities will always be complex, but your order entry system doesn’t have to be. With the right annuity order entry system, you can streamline workflows, cut NIGO rates, and give advisors a faster, more consistent experience. That’s not just an operational upgrade—it’s a competitive edge.

Ready to see how AFFIRM can streamline your annuity business and reduce NIGO for good? Let’s Build Your Business Case.

Key Takeaways

Q1: Why are traditional annuity platforms problematic?

A: Legacy systems create friction through outdated workflows, excessive manual steps, and inconsistent processes – slowing down advisors and increasing NIGO rates.

Q2: What do advisors and firms want from annuity tech?

A: They want flexible systems that adapt to their workflows, reduce compliance burdens, and drive adoption – without surprise costs.

Q3: How can the right platform make a difference?

A: A modern annuity platform simplifies submissions, supports industry standards, and cuts rework – freeing advisors to focus on clients, not corrections.

Citations:

1: LIMRA Secure Retirement Institute – ‘Advisors Views on Making the Annuity Sales Process Simpler’

2: Cerulli Associates via InvestmentNews – ‘Three-quarters of advisors flag compliance as a top tech challenge’

3: Cerulli Associates –State of U.S. Wealth Management Technology 2025: Cerulli